Airport traffic retains strong growth momentum during Q3

9 November 2017Brussels - European airport trade body, ACI EUROPE today releases its air traffic report for September & Q3. The report is the only industry report that includes all types of civil aviation passenger flights: full service, low cost and charter. It shows that during the third quarter of this year, passenger traffic at Europe’s airports grew by +9% - slightly less than in Q2 (+10.6%).

The growth momentum in Q3 gained further traction in the non-EU market, where passenger volumes increased by +15% (+13.1% in Q2). The main drivers were a now complete recovery from last year’s downturn for most Turkish airports, as well as buoyant growth at many airports across Russia, Ukraine Georgia and Iceland.

Meanwhile, EU airports maintained their strong pace in passenger traffic growth at +7.4%. This followed an exceptional performance in the preceding quarter (+10.0% in Q2), which partly reflected catch-up growth from 2016 when terrorism dampened demand. In line with trends established earlier in the year, countries to the East of the EU bloc achieved double-digit growth along with Cyprus, Luxembourg, Malta and Portugal.

The Majors (Europe’s top 5 busiest airports) saw passenger traffic growing by +5.8% in Q3 - led by Istanbul-Atatürk (+11.7%) which was followed by Amsterdam-Schiphol (+6.1%), Paris-CDG (+5.7%), Frankfurt (+4.9%) and capacity constrained London-Heathrow (+1.7%).

Freight traffic across the European airport network during Q3 remained consistent with the previous quarter, coming in at +9.5% (+9.2% during Q2). Aircraft movements also remained robust at +4.4% (+4.3% during Q2) – pointing to sustained airline capacity expansion.

Olivier Jankovec, Director General ACI EUROPE commented “We are now experiencing a synchronized air traffic growth dynamic in the EU and non-EU markets. This is propelling airports across Europe towards record traffic results – with EU airports in particular having expanded passenger traffic by more than 20% over the past 3 years. That growth also puts a lot of pressure on airport facilities and staff – with operational efficiency and quality becoming a daily challenge for many airports.”

He added “As long as economic conditions keep defying geopolitical risks, air traffic will continue to grow - spurred by the increasing reliance of businesses and consumers on air connectivity. The fact that economic sentiment in the EU has just reached historic highs is encouraging – even though recent spikes in oil prices are a worry. For now, disruptions to air traffic in Europe are coming from airlines having gone bust, being partially taken over or massively cancelling flights and reducing capacity due to operating issues. Expect more impact from that on traffic figures in the coming weeks.”

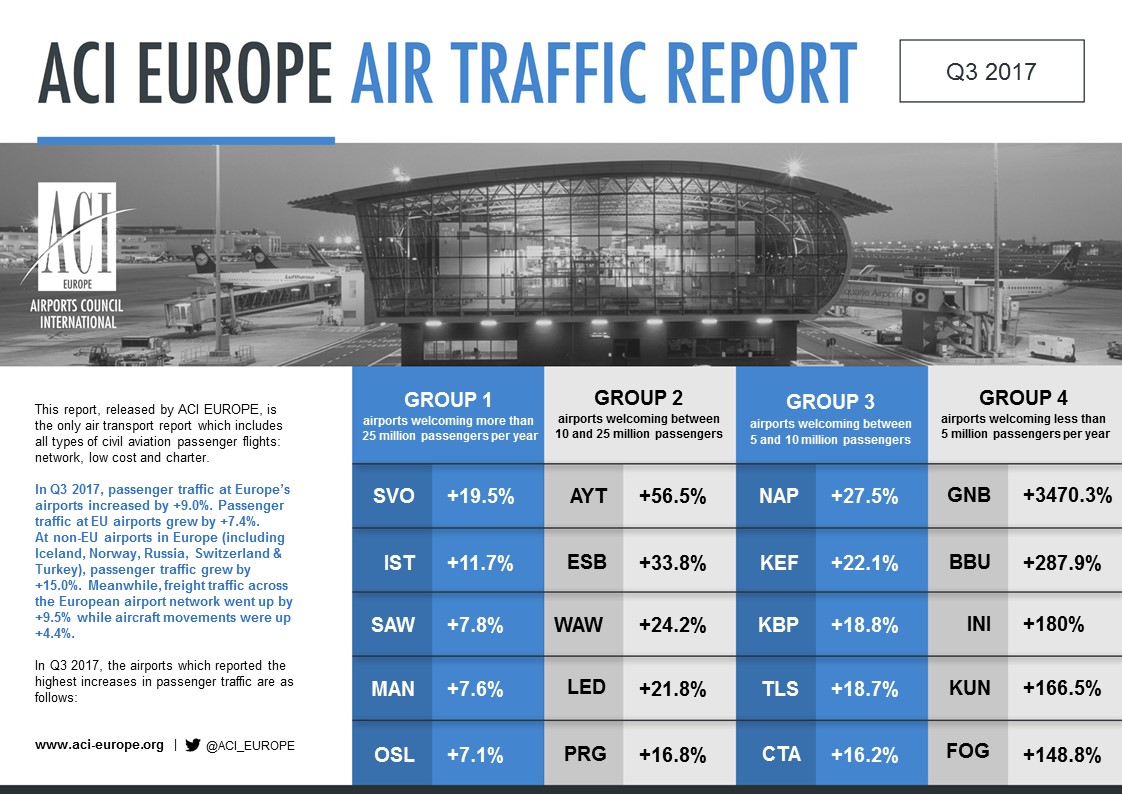

During Q3, airports welcoming more than 25 million passengers per year (Group 1), airports welcoming between 10 and 25 million passengers (Group 2), airports welcoming between 5 and 10 million passengers (Group 3) and airports welcoming less than 5 million passengers per year (Group 4) reported an average adjustment +5.5%, +13.3%, +10.0% and +10.9%.

The airports that reported the highest increases in passenger traffic during Q3 were as follows:

GROUP 1: Moscow SVO (+19.5%), Istanbul IST (+11.7%),

Istanbul SAW (+7.8%) Manchester (+7.6%) and Oslo (+7.1%)

GROUP 2: Antalya (+56.5%), Ankara (+33.8%), Warsaw WAW (24.2%), St Petersburg (+21.8%) and Prague (+16.8%)

GROUP 3: Naples (+27.5%), Keflavik (+18.8%),

Kiev (+18.8%), Toulouse (+18.7%) and Catania (+16.2%)

GROUP 4: Grenoble (+3,470.3%), Bucharest BBU (+287.9%),

Nis (+180%), Kaunas (+166.5%) and Foggia (+148.8%)

During September, airports welcoming more than 25 million passengers per year (Group 1), airports welcoming between 10 and 25 million passengers (Group 2), airports welcoming between 5 and 10 millionpassengers (Group 3) and airports welcoming less than 5 million passengers per year (Group 4) reported an average adjustment +5.2%, +12.0%, +10.4% and +11.3%.

The airports that reported the highest increases in passenger traffic during September were as follows:

GROUP 1: Moscow SVO (+15.7%), Istanbul SAW (+7.9%),

Manchester MAN (+7.5%) Istanbul IST (+7.3%) and Moscow DME (+7.2%)

GROUP 2: Antalya (+49.8%), Ankara (+29.2%), Warsaw WAW (24%), St Petersburg (+20.5%) and Izmir (+16.4%)

GROUP 3: Naples (+27.9%), Keflavik (+23.9%),

Kiev (+19.5%), Catania (+17.5%) and Faro (+17.4%)

GROUP 4: Grenoble (+2,058.1%), Foggia (+463.6%),

Bucharest (+247.7%), Klagenfurt (+191.6%) and Craiova (+134%)

The 'ACI EUROPE Airport Traffic Report – September & Q3 2017’ includes 252 airports in total representing more than 88% of European air passenger traffic.